Why should I use farm insurance brokers and what value can they provide to my farm insurance program?

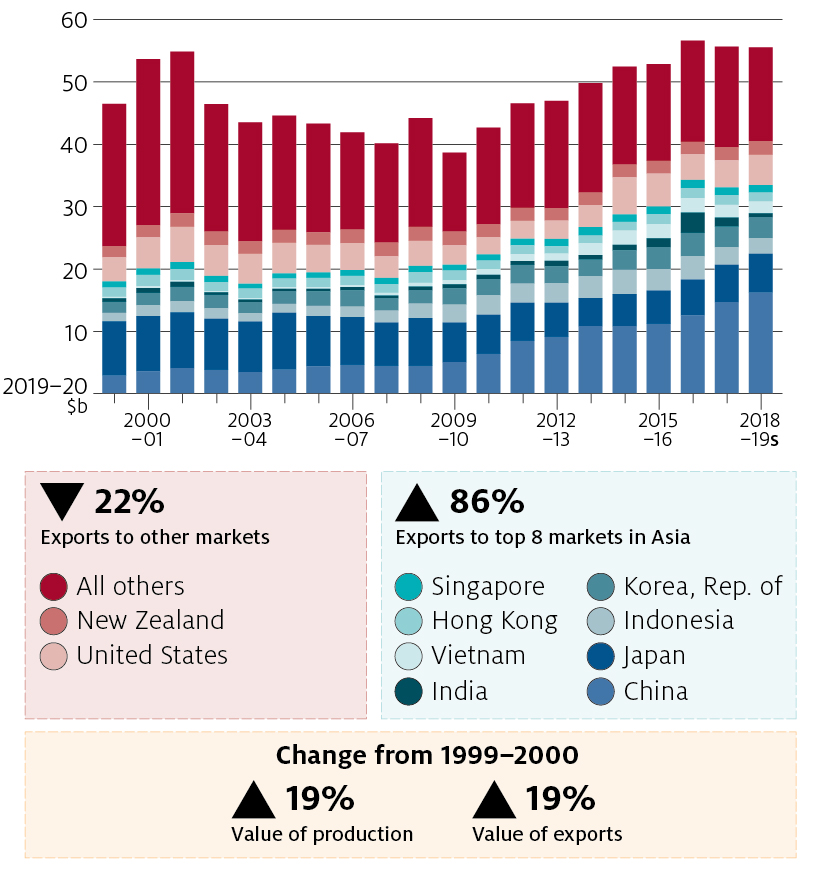

Over the past 20 years, Australian agriculture has grown by over 19%, with 58% of Australian land now being used for agriculture. Agriculture within Australia, accounts for 11% of the total goods and services exported.

The increase of farm sizes and corporate operations continue to change the risk profile for many farms. Larger farms continue to diversify with multi-faceted operations that no longer suit an “off the shelf” farm insurance policy.

It is important that larger farm operations work with a farm insurance broker who specialises in agricultural risk and has the ability to source and implement market leading farm insurance solutions.

Should I Use Farm Insurance Brokers?

Farm insurance brokers work on your behalf, not the insurers. They will provide advice to better manage your farm risk, as well as source and implement the most appropriate insurance products based on the needs of your farm operation.

Unlike an insurance broker, a direct insurer may have limited market access in terms of products and pricing. It is vital that larger farms have the ability to be provided with access to many different insurance products both locally and overseas.

What Do Farm Insurance Brokers Do?

- Review and assess potential farm risks

- Work on behalf of your farm business, not on behalf of the insurer

- Source multiple insurance products and pricing within the market

- Have a thorough understanding of the insurance market and the ability to negotiate premiums on your behalf

- Manage claims on your behalf including lodgment and negotiation with the insurer to provide the best possible outcome

- Remain up to date with policy wordings, industry changes and emerging farm insurance risks

Emerging Risks For Agriculture

Farm Liability Insurance

Farm Labour Hire

As farms have grown, so too has the use of contractors and labour hire personnel. The use of labour on farms has changed significantly over the past decade.

It is important that a farm insurance broker is utilised to ensure the most appropriate farm liability insurance is sourced for your farm business, taking into consideration the use of labour hire and contractors engaged.

Farm Export Insurance

Australia exports 70% of the total value of agriculture, fisheries, and forestry production.

Fruit and vegetable exports have increased by 69% and this sector continues to be the most reliant on labour hire, casual labour and contractors.

Many larger farms within the horticultural and beef sector are now exporting directly overseas and it is important that these risks are considered not only for liability but also for marine and trade credit insurance for farms.

Source: www.agriculture.gov.au/abares

Farm Liability Insurance Policy Coverage

There are significant differences in farm liability policy wordings including claims made vs claims occurrence and geographic restrictions. A farm insurance broker will have the ability to advise on the most appropriate liability cover for your farm.

Product Recall Insurance For Agriculture

With many larger farms now supplying retail supermarkets directly, the costs associated with product recall due to contamination and maintaining brand reputation can be significant. On average, nearly 10 product recalls occur every week within Australia, with food and beverage being the most commonly recalled products.

Product Recall Liability Insurance For Farms Can Provide Cover For:

- Accidental contamination

- Product tampering

- Product extortion

- Alleged contamination

- Government recall

- Adverse publicity

- Reworking costs

- Business interruption

Source: www.foodstandards.gov.au/industry/foodrecalls

Farm Livestock Insurance

Australia is regarded as having one of the best bio-security programs in the world. We have seen the devastating impacts on overseas agricultural economies from disease outbreaks, such as African Swine Fever and Foot and Mouth Disease. Farms within Australia are now more intensive with larger livestock numbers which can pose a greater financial risk for farms.

With the increase in free range farming operations such as egg and poultry farms, this can also increase the risk of illness and disease being introduced into farm from wildlife, such as migratory birds.

The risk exposure for many of these intensive and free range farming operations is not only the financial loss of livestock, but also the interruption to the farm business and supply chain, should a government quarantine restriction be placed on a farm. This was seen recently in Victoria where a number of farms were quarantined due to an outbreak of highly pathogenic H7N7 avian influenza.

At Agripro Insurance Brokers, we can tailor dedicated livestock insurance programs for poultry farm operations, poultry processors, piggeries, and beef feedlots to include farm business interruption insurance in the event of government quarantine and or slaughter.

Farm Management Liability Insurance

Management liability insurance is not new to the insurance industry, however, it often a cover that is overlooked within the agricultural sector.

Agriculture in Australia directly employs over 300,000 workers. With the increase in labour and corporate responsibility the risk on agricultural operations is now greater than ever. There has been significant changes to OH&S laws within Australia over the past decade and more recently within Victoria in July 2020.

Changes in legislation continue to increase the risk profile for agricultural operations and it is vital that any farm business or partnership considers farm management liability insurance.

Farm Management Liability Insurance Can Provide Cover For:

- Directors & officers liability insurance

- Statutory liability insurance for fines or penalties such as

- EPA

- Occupational Health and Safety

- Employment practices liability

- Unfair dismissal

- Workplace harassment

- Failure to employ or promote

Drought Insurance for Farms

Index insurance is based on an agreed predetermined index that will pay out in the event of weather related or catastrophic events. As Index insurance does not generally require the use of claims assessors, it will allow the claims process to be much quicker and more factual for farms.

Weather index insurance is already being used by many cropping farms where the predetermined index is developed prior to the commencement of the policy.

Weather Index Perils That Can Be Insured:

- Insufficient or excessive rainfall

- Extreme temperatures such as

- frost

- humidity

- windspeed

- Seasonal rainfall

How Farm Weather Index Insurance Is Used:

- Insufficient rainfall that results in a reduced crop yield

- Excessive rainfall and wet harvest cover resulting in reduced yield or downgrade

- Frost that results in a reduction of yield

- Reduction in seasonal rainfall

Weather Index Insurance For Agriculture

Weather index insurance can also be considered for agricultural suppliers or processors who may be indirectly impacted by weather related events.

Examples Of Weather Index Insurance Applications:

Fertiliser Suppliers

Farms within the specified region receive below average rainfall which results in a reduced volume of fertiliser being used. The reduced volume used on farm impacts the financial income of the fertiliser business.

Meat Processors

A reduced seasonal rainfall results in lower processing numbers for a meat processing facility which financially impacts the business.

Milk and Cheese Processors

Farms that supply the dairy company received below average rainfall within the region, which reduces the milk yield and financial income of the milk processing company

Agricultural Investment

A portfolio of agricultural operations managed by an investment fund receive below average rainfall for the season which impacts the investment return for the company and shareholders.

Agripro Insurance Brokers have access to over 150 global insurance products we can provide customised agricultural insurance solutions for any large or corporate farm. Australian farms are highly diversified and our experts have global market access and knowledge to help manage your risk.